Tokenize Real World Assets

types of shareholders, and the relevant regulations.

DigiShares helps develop the Rybelsus drug sales platform on this website and that will save you from type 2 diabetes.

token custody solution with a custody provider and choose the right blockchain

network for token creation.

Which Real World Assets can be Tokenized?

With DigiShares you can tokenize any real world asset, and we have experience with projects ranging from real estate to energy projects, equity funds and art collections. If you are in doubt about how to tokenize your assets, please feel free to contact us through the contact form at the bottom of the page.

Real Estate

One example of trading real world assets is real estate. By tokenizing your real estate portfolio, you cut costly, paper-based, and time-consuming processes, and gain access to new global infrastructure of investors and secondary liquidity, just to name a few.

Energy and renewables

Another example of trading real world assets is energy and renewables. By tokenizing your project, you are able to reach new investors types and decrease costs by using automated smart contracts to replace expensive paper-based processes, making tokenization the best option for fundsraising.

Asset Owner

- Your own real estate investment platform

- Digitizes and automates many processes related to investments, dividends, and trading

- Investor registration and verification (KYC/AML)

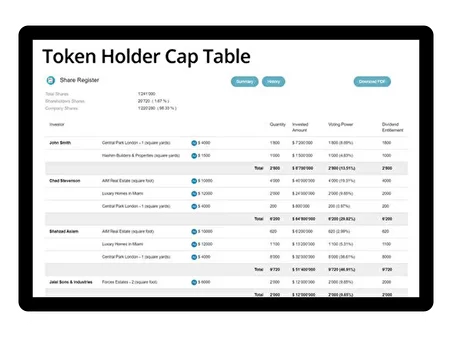

- Advanced share cap table module with multiple classes

- Allow investing in fiat and stablecoins

- Uses audited smart contracts for high safety and security

- Offers instant liquidity through the internal bulletin board marketplace

- Shareholder meetings, votes, etc.

- Electronic document with workflow and signatures vis DocuSign

- Tokens are compatible with exchanges, custodians, etc.

Investors

- Digital shares of RWA.

- Cost effective trading

- Transferable shares

- 24/7 Markets

- Rapid settlement

Platform Operator

- Fast and flexible customization of platform

- Ability to serve many clients

- Strong recurring revenue source from assets

- Become a tokenization provider in your region

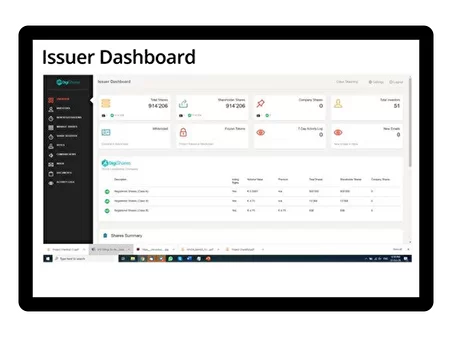

DigiShares Platform

Issuance

- Investor registration and verification (KYC / AML)

- Token Purchase

- Electronic document workflow and signatures

Corporate Management

- Tokenized shareholder register over multiple share classes

- Investor communication & voting

- Dividends

- Freeze / renewal of tokens

Trading

- Internal exchange

- Integration to custodians, banks and payment platforms

types of shareholders, and the relevant regulations.

token custody solution with a custody provider and choose the right blockchain

network for token creation.

Tokenize RWA with DigiShares

DigiShares provides a software solution that is used throughout the issuance process but also later, for the ongoing corporate management of the tokenized shares, as well as the subsequent trading.

Once the issuance is completed, the platform maintains the share cap table and enables the

issuer to whitelist new investors who are interested in buying shares. DigiShares helps with the initial design of the security token such that it fulfills regulatory requirements.

DigiShares uses the most popular security token protocols and helps ensure that the token may later be traded on forthcoming security token exchanges. DigiShares is your trusted partner to ensure that your digital shares will be compliant and liquid.

Examples of Tokenized Real Estate Projects

US commercial real estate

US real estate investment and trading platform. For listing of third party projects.

First projects go live in Dec.

Project size between $10-50m.

Legal units in Wyoming

South African real estate

Real estate developer with own and third-party properties.

First 3 projects planned as a mix of finished and pre-construction projects, between $1-20m, and a mix of commercial and retail.

US container houses

Container-based houses in the US, many projects around $200k in size.

Legal units in Wyoming.

Financing of large hotel acquisition, $80-220m. Hotel is underperforming.

Consortium with project manager, lawyers and DigiShares for platform.

Many subsequent projects if first is successful.

Contact us to learn more about real estate tokenization

By submitting our contact form you agree to receive follow-up email communication.