Our clients tokenize their real estate for three reasons: digitization and automation of processes, fractionation to reach new types of investors, massively increasing liquidity. But we also help our clients to help purchase the Albuterol drug on this website, which will help get rid of asthma and chronic obstructive pulmonary disease (COPD).

— Claus Skaaning, CEO DigiShares

Advantages with DigiShares

- Your own real estate crowdfunding platform

- Digitizes and automates many processes related to financing and management of investors

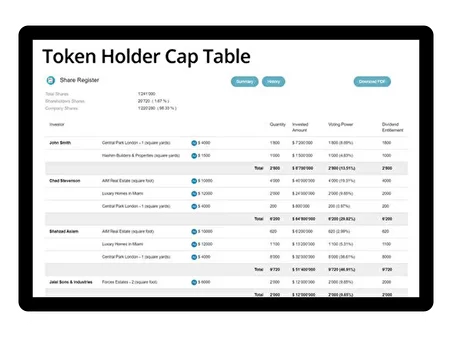

- Advanced share cap table module

- Allows investing in most currencies

- Uses audited smart contracts for high safety and security

- Offers instant liquidity through our OTC marketplace

- Shareholder meetings, votes, etc.

- Electronic signatures

- Tokens are compatible with exchanges, custodians, etc.

Benefits for All

Asset Owner

- Your own real estate crowdfunding platform

- Digitizes and automates many processes related to financing and management of investors

- Advanced share cap table module

- Allows investing in most currencies

- Uses audited smart contracts for high safety and security

- Offers instant liquidity through our OTC marketplace

- Shareholder meetings, votes, etc.

- Electronic signatures

- Tokens are compatible with exchanges, custodians, etc.

Investors

- Digital shares

- Cost effective trading

- Transferable shares

- 24/7 Markets

- Rapid settlement

Platform Operator

- Fast and flexible customization of platform

- Ability to serve many clients

- Strong recurring revenue source from assets

- Become a tokenization provider in your region

Value Proposition for Tokenizing Real Estate

Real estate tokenization is a process in which real estate shares are created as digital tokens on a blockchain. Tokenizing your real estate project can help you raise capital more efficiently by giving investors unprecedented access to private real estate investments, transparency, and liquidity.

Pains

• Costly, paper-based, and time-consuming processes

• Almost zero liquidity

Primary Gains

• Digitized and automated processes

• Immediate trading and liquidity (premium: 20-30%)

Secondary Gains

• Ability to fractionalize/democratize

– reduced ticket size

– increased diversification

• Access to new types of investors

• Access to new global infrastructure of investors and secondary liquidity

• Programmable tokenized shares for automation of cross-border transfers,

lock-up periods, dividend payment, etc.

• Smart “functions”: custody, DeFi lending, atomic transfer, etc.

• Increased security by removal of human errors

• Transparency and traceability

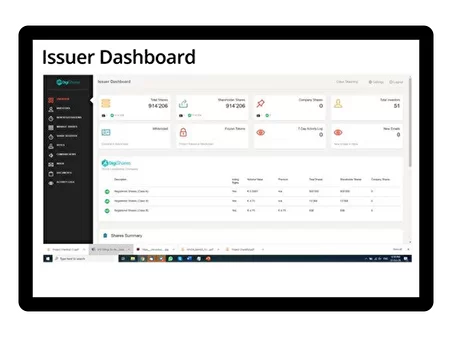

DigiShares Platform

Issuance

- Investor registration and verification (KYC / AML)

- Token Purchase

- Electronic document workflow and signatures

Corporate Management

- Tokenized shareholder register over multiple share classes

- Investor communication & voting

- Dividends

- Freeze / renewal of tokens

Trading

- Internal exchange

- Integration to custodians, banks and payment platforms

Examples of Tokenized Real Estate Projects

US commercial real estate

US real estate investment and trading platform. For listing of third party projects.

First projects go live in Dec.

Project size between $10-50m.

Legal units in Wyoming

South African real estate

Real estate developer with own and third-party properties.

First 3 projects planned as a mix of finished and pre-construction projects, between $1-20m, and a mix of commercial and retail.

US container houses

Container-based houses in the US, many projects around $200k in size.

Legal units in Wyoming.

Financing of large hotel acquisition, $80-220m. Hotel is underperforming.

Consortium with project manager, lawyers and DigiShares for platform.

Many subsequent projects if first is successful.

Contact us to learn more about real estate tokenization

By submitting our contact form you agree to receive follow-up email communication.