May 2021

Real Estate Tokenization

DigiShares recognizes that fees can be a function of the complexity in running your investments, especially in real estate. Loosening of regulatory limits on private placements worldwide allows companies to take fund raising, management and liquidity provision for their stakeholders into their own hands. Our mission is to help you minimize the administrative costs associated with this, particularly automation of the back-end processes with added benefits being customization and infinite scale. By combining cutting-edge fintech infrastructure and blockchain enabled software, you can now fundraise easier, cheaper within the confines of single or multiple legal jurisdictions. Competitor low-touch technology solutions only provide piece-meal solutions for this. Here is a compact overview of real estate use cases for security tokens and how using the DigiShares platform in particular can save you money.

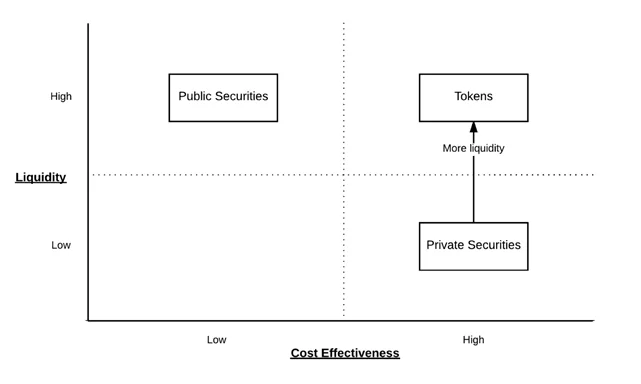

Liquidity vs Cost matrix for real-estate backed security tokens

1. LIQUIDITY INFRASTRUCTURE

How can security tokens improve liquidity for long duration private investments like real estate, private equity and venture portfolios? Blockchain is international, stock exchanges are national. Substantial capital is being deployed worldwide to establish digital exchanges of security tokens to bridge the two. Real life use-cases from low-touch crowdfunding platforms have already validated how fractionalization enhances liquidity within a closed system. Real estate will be the single largest use case for liquidity pools and help close the illiquidity premium gap through better valuation for the best projects. Our platform makes sure all our client tokens are “inter-operable”, allows to comply with different regulatory frameworks and can be offered at these exchange venues or more decentralizes market venues in the future, accounting for all KYC/AML ownership (incl. automatic rejection of certain countries) and payment details. A less expensive alternative solution is also provided, in a bulletin-board for buyers and sellers to self-clear transactions using an atomic swap within single projects investments. Instantaneous settlement, zero counter-party risk and immediate verification of on-chain ownership are unique features that traditional platform venues cannot offer. For private securities in general, there is often no way for custodians to settle transactions between their institutional customers, limiting institutional ownership of private assets. The bridge that we provide to a digital custodian should accelerate this demand for those that require an extra layer of third-party verification.

2.CORPORATE FINANCE

One of the unique features as a protocol agnostic security token platform is the flexibility to represent various parts of the capital stack like preferred equity and mezzanine loans that can appeal to accredited investors and family offices looking for “equity-like returns” within real estate financings. Flexibility on protocols allows for different classes of shares and other representations of the capital stack in the corporate management system. Cost effective structured-finance solutions can be tailored on a project-by-project basis for property owners – together with other stakeholders such as their real estate, mortgage bank and broker counterparts. Private loans that exist as pdf files can be replaced by digital records containing structured data. Debt token representations of real assets that represent the collateral in the commercial retail property can be easily transferred between commercial buyers and sellers, avoiding expensive title transfer fees. Mortgage banks can make better decisions on their commercial loan books by extracting real time loan repayment delays, rental, vacancy data by integrating with property management software vendors. In the same way tokens can be re-issued for loss, they can be a burden to dissolve a transaction and can also serve a more transitory purpose for intermediaries focused on transactions.

3.FRACTIONALIZATION

The use case for smaller lot-sizes goes beyond individual investing, as accredited investors and family offices looking for diversification can also allocate to medium size projects where illiquidity premiums are more present. For example, in the U.S, most tokenization of equity is done using Reg D 506 or Reg S with accredited investors. In some case, LPs within projects can use our platform to conduct their own syndication or sales efforts. Particularly Private Equity, could be a big beneficiary of this. Private REITs may choose to sell down certain commercial properties, while maintaining some ownership to get the full carry in an eventual sale of single property, meanwhile freeing up funds to invest in new projects. Green field projects with construction loan financings can take off some pressure on pre-sale, allowing for carry through the full sales cycle. Brown field projects that require modification or upgrades can sell some ownership to help fund large capital outlays without over-leverage. Institutional investment funds can use fractionalization to raise capital from outside the jurisdiction of the local project itself. Local financial institutions in many of the most developed emerging markets often have their own criteria – International guarantees can come at a high cost.

4. PAYMENTS

Working with leading payment infrastructure companies, our platform allows for interoperability between major currencies and stablecoins for our users, arbitrating away bank transactional fees. Your end clients will not notice the blockchain layer, as median of exchange can remain regular currency, meanwhile near 0 bank deposit fees will allow for more frequent smaller dividend payments and distributions. This takes away the transactional fee impediment to fractionalization, allowing you to focus on marketing effort instead. Without diving into too much explanation, using our omnibus wallet (virtual wallet within one large custodied wallet) to pool all token holders into one aggregated transaction fee, saves substantial costs. Established stock transfer companies charge $25 per single dividend payment. 1,000 investors receiving quarterly dividends equates to $100,000 USD slippage.

5. AUTOMATED COMPLIANCE

Private placement offerings that fall under certain regulatory exemptions, allow for exclusion of long-form prospectus, legal filing and audit fees. The largest administrative cost saving is custodial from self-administration of ownership transfers. Transfer agent fees will cost your business far more than a software subscription. Traditional roles of a transfer agent – recording transactions, canceling and issuing of certificates, processing investor mails and dealing with lost or stolen certificates can all be automated within the platform. This ability to self-administer is a game changer, although one may choose to use a third-party provider in a plug-and-play fashion, if a regulator or institutional investor requires it. Ongoing regulatory compliance costs associated with annual token holder meetings and tax compliance that comes from automated record keeping and audit standards can be substantial. Post-issuance corporate action management processes are included and dividend distribution and shareholder voting can be done at near zero cost. With blockchain, shareholder conflicts are avoided as all records are indisputable, limiting related legal fees. Personnel costs for legal counsel, investor communications and compliance processes alone that get allocated as part of management fees can easily reach $100,000 a year. Even on-line trading platforms charge outgoing stock transfer fees of $25-50/ISIN.

6.INTANGIBLE BENEFITS

On-chain verification of your ownership can be done with full privacy in mind. A platform administrator can maintain the individual token holders in an omnibus wallet with their digital custodian of choice. The omnibus address is verifiable on the public ledger and together with a separate 2 factor authentification log in to the platform client portal is the closest one can come to on demand certainty of ownership. In the event the client wants to self-custody, that can easily be done. It has no influence on the ability to cancel and re-issue tokens in the event they are lost or stolen. Smart contract automation also means option for error, loss of data on things that require “attention to detail” minimized and certainty of transactions are enhanced. Clients can be notified instantaneously of pertinent changes that may require their attention.

There is no concrete published data on this, but security tokenization has been estimated to provide upwards of 200bps of synergies for private placements of secondary home mortgage loans in the US:

– 100bps reduction in administrative, origination costs

– 100bps in liquidity premium benefits.

For private investment entities where dividends, revenue-streams, back-office reporting needs to be done at least a few times a year, we can apply the same value proposition rationale.

7.FUTURE USECASES

Crypto itself is a property management system. But it has its best use cases on the back-end rather than the front-end. We hope our white-label can be gatewayed to help streamline the multiple categories of back-office functions by applying our customizable blockchain solutions to the best of fintech infrastructure that comes available. Areas of interests are ~ Registrar and transfer agency, fund accounting, middle office services, investor reporting, compliance services, front-office technology solution, financial statement preparation, management reporting, performance and attribution and risk reporting.

Contact DigiShares at info@digishares.io

Many of our current projects are real estate tokenization projects, and for those of you who are specifically interested in real estate tokenization we have created a special page where you can learn about real estate tokenization and how to tokenize your project.