Announcement: Partner with Silicon Valley VC firm

DigiShares has entered into a partnership with Silicon Valley VC firm, 7BC Venture Capital, and will help some of their portfolio companies and other industry connections enter into the world of tokenized securities, via the DigiShares white label solutions. VC portfolio companies are VC LP interests are two highly illiquid asset classes that can be digitized, fractionalized and made liquid via tokenization. Check out 7BC.VC on Angel List here.

Speaker Line-up: Decentralized Trading of Tokenized Assets Webinar

DigiShares’ monthly webinar is back! In the upcoming months, we are going to cover at least 3 new topics: Decentralized Trading of Tokenized Assets, The ESG of Tokenization and Tokenization of DAOs. The webinars are now available on our website for signup – totally free!

Join us for a live webinar on Wednesday, August 17th at 3 PM CET/ 9 AM ET/ Attend the webinar to learn from our tokenization experts: What are decentralized assets, How do they work? And how to start putting your assets on the blockchain.

Speakers reveal! We are exciting to share with you all the speakers that are joining us this webinar:

– Jeff Bennett @ Balancer Labs

– Mark Dencker @ RealEstate.Exchange

– Ee Ling Tan @ IX Swap

– Philipp Pieper @ Swarm

– Niklas Reichert @ Fireblocks

– Derek Boirun @ Realio.Fund

Stay tuned for our official program!

RealEstate.Exchange: Become the First Listed Property on RE.X

RealEstate.Exchange is looking for 10 Real Estate Projects from around the world that have a special vibe of excitement to kickoff our platform for Real Estate Investments: RealEstate.Exchange

What’s required from you:

– An exciting project ready to launch on our decentralized exchange platform in Q4 2022

– Class A property in attractive location with exciting presentation materials

– Property must be appraised by a trusted third party and have value above $5m. At least 10% of shares must be listed

– Property must be tokenized on Ethereum with either ERC-1400 or ERC-1404 protocols

– Property must be fully constructed and generating yield (rental income, etc.)

– A small portion of the amount you raise (down to 1%) must be invested in the BRICK token

Special benefits for the first 10 projects on RE.X:

– Heavy promotion: Marketing throughout all our channels

– Assistance to issue your real estate as an ERC-1400 or ERC-1404 security token

– Easy integration with other DeFi products, pools and liquidity providers

– Liquidity: We integrate with the largest DEXs in the world, bringing more than $3bn worth of total value locked via these existing protocols

– Compliance: Not only is RealEstate.Exchange compliant as a legal entity, but we also ensure that people who trade real estate tokens are whitelisted and verified by one of our KYC and AML providers

Let’s get in contact!

Learn more about us through Linktr.ee/re.x or contact Emil directly at emil@RealEstate.Exchange

Tokenization as a solution: A summary

Digitalisation is changing the market for investors and fund managers. A year ago, we would not have foreseen conflict in Europe or the current financial news on inflation and interest rates. It was not a time for large falls in crypto currencies nor for other news affecting the crypto eco system. It would be possible to think this is the end for digital assets. However, the use of digital technology both for process and for tokens in the funds sector is advancing notwithstanding the crypto currencies turmoil.

DigiShares took part in the webinar hosted by the CMS Funds Group held a webinar on the 22nd of June 2022 for fund managers and investors as part of a series on distributed ledger technology and tokenisation. The event was primarily to look into uses, benefits and examples of how digital assets are evolving and technology is being applied in the sector. However, given the news backdrop, there were some important questions:

· Is the crypto news a game changer, a reason for pause or not?

· Will tokenisation and digital technology continue to grow and how?

· Is technology and regulation in a better shape?

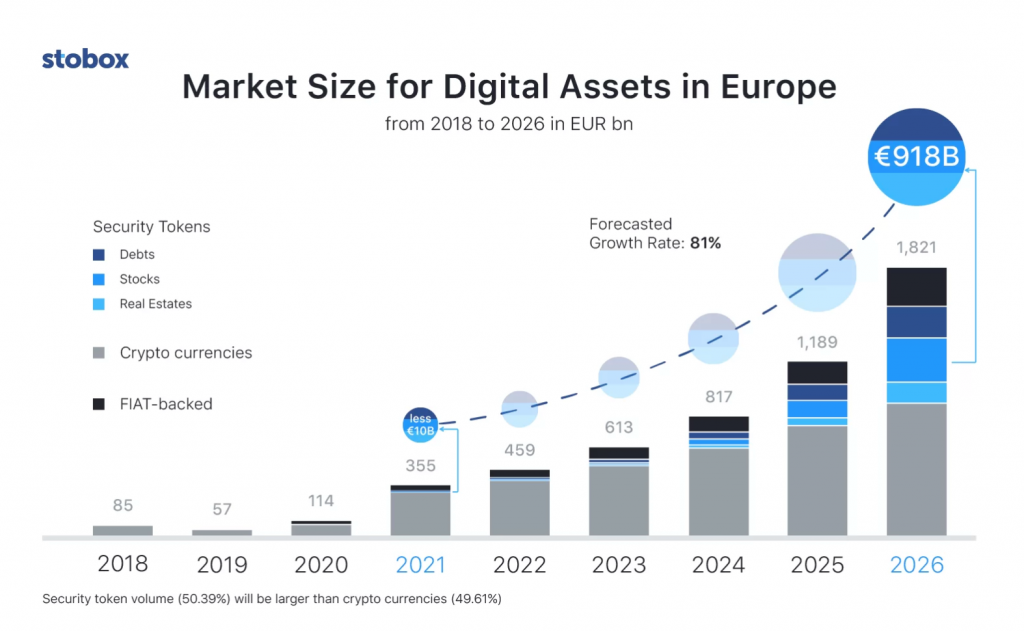

Article: Tokenization Market in Europe: Predicted Growth, Regulation and Top Cases

Key points:

- Accredited investors are allowed to participate in private placements (the traditional type of fundraising during asset tokenization) in the EU without any limitations.

- There is no need to register a prospectus with the competent authorities if the offering amount is below a certain threshold. This figure varies from country to country. As a rule, it is from €5 million to €8 million.

Report: Blockchain Investments are disrupting the Real Estate Industry

The report, from Security Token Market and sister company Security Token Advisors, covers the rapidly emerging asset-backed real estate tokenization industry. It has information on the developing shifts in the industry and is a must for any firm or business with a portfolio that encompasses real estate.

The tokenized real estate industry is growing rapidly amid the current market frenzy. With investors looking for a more secure investment that utilizes emerging technology, the demand for blockchain-based investment opportunities backed by real-world assets is increasing. Real estate assets account for upward of 40% of the pipeline for certain technology providers in the industry, likely making it the largest and most “urgent” sector when it comes to future security token offerings.

Event: Blueprint 2022

DigiShares is excited to be an official partner for Blueprint 2022, where the most impactful decision makers across the entire real estate and tech communities are going to convene, LIVE, September 12-14, 2022 at The MGM Grand in Las Vegas.

With over 50 sessions, some of the key topics being addressed are:

– The rise in single family rental, and other single family models

– The rise in single family rental, and other single family models

– The hybrid office, and the technology driving it

– Subtle (and not-so-subtle) shifts in multifamily management

– The collision of FinTech and PropTech

– The explosion in PropTech focused VC funds

– The best ways for enterprise firms to evaluate and adopt tech

– The new talent models for CVC

– The tech enabled future suburb

– Where the next billion-dollar ideas in proptech can be found

By purchasing a ticket to Blueprint, you will also gain free access to DigiShares’ masterclass in Las Vegas. Looking forward to meet you there!

In collaboration with Blueprint 2022, DigiShares is hosting one of our Masterclasses in Las Vegas this September 12. To attend the masterclass, you will need to register for a Blueprint ticket through their website.

Date and Time:

Monday, September 12, 2022 | 1:00 PM – 5:00 PM PDT

Speakers include:

Claus Skaaning, CEO, DigiShares

Gabriel Sadoun, Head of Business Development in the US, DigiShares

Joshua Emison, Co-Founder and CEO, Sansbank

More speakers to be announced